Did you know that by adding $500 extra to your monthly payment, you can shave off thousands of dollars in your loan and a few years off your repayment? When using our How Much Will I Pay Over Time Calculator, all you need to do is to put in the original loan amount, loan term, interest rate, start of the original loan, and the additional principal payment, and the calculator will let you know how much you will save in money and how many years will be shaved off your loan.

Unsure of how much you can save if you make additional payments? Click on our What If I Pay More calculator, and you will see how many thousands you can save even if you pay an additional $155 to your principal loan. You will also see a decrease in the number of years when you pay more.

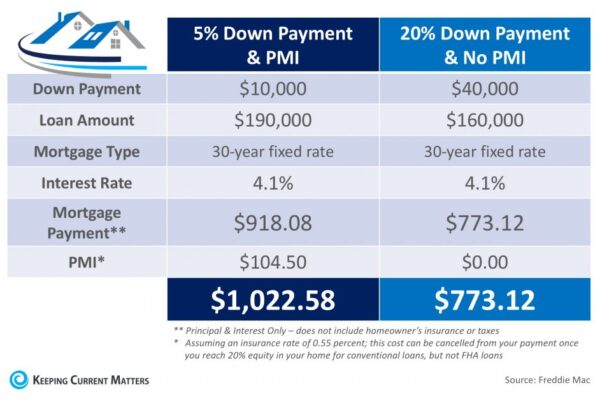

Our Down Payment Calculator will help you decide how much you can afford to put in as a down payment once you put in the loan amount, length of the loan, and interest rate. By clicking “calculate,” you will immediately know if the down payment you need is within your reach or if you can afford a larger amount.

Strapped for cash, and you want to save a couple of hundred dollars in the short term? Or maybe there is a better offer on your existing mortgage that will help you save in the long term? American Mortgage Corporation Should I Refinance calculator can help you decide when you see the possible savings you will get in the short and long term.

Another helpful calculator that you can find on the AMC website is the How Much House Can I Afford calculator. What this calculator does is that it helps you see how much you can afford by using your monthly budget and expected down payment. To use this calculator, just put your monthly income, monthly debt, interest rate, and length of the loan to help you estimate what you can afford to pay.

Do you want to know how much income you will need to afford the home you are interested in? All you need to do is to put in the original loan amount, length of the loan, interest rate, property tax, mortgage insurance, and all the loans and obligations that you are repaying – auto loan, credit cards, student loans, alimony, and child support and other loans you might have, and our Income Requirement calculator will tell you how much your income should be.

It is always best to talk to our financial experts for a more detailed and personalized loan program. Let us know how we can help you.