Unless you’ve been living under a rock, you know that the past few years have brought some tough economic times. Getting a new home is one of the most challenging things to deal with during these tough economic times.

Choosing the right mortgage lender is essential if you’re looking for a new home. With so many options, it can be challenging to know where to start. That’s why we’ve compiled a top 3 list of the top-rated mortgage lenders in the USA. These lenders have a proven track record of providing quality service and competitive rates.

So whether you’re looking for a conventional FHA, or even a USDA mortgage, we’re confident that you’ll find the perfect lender on our list.

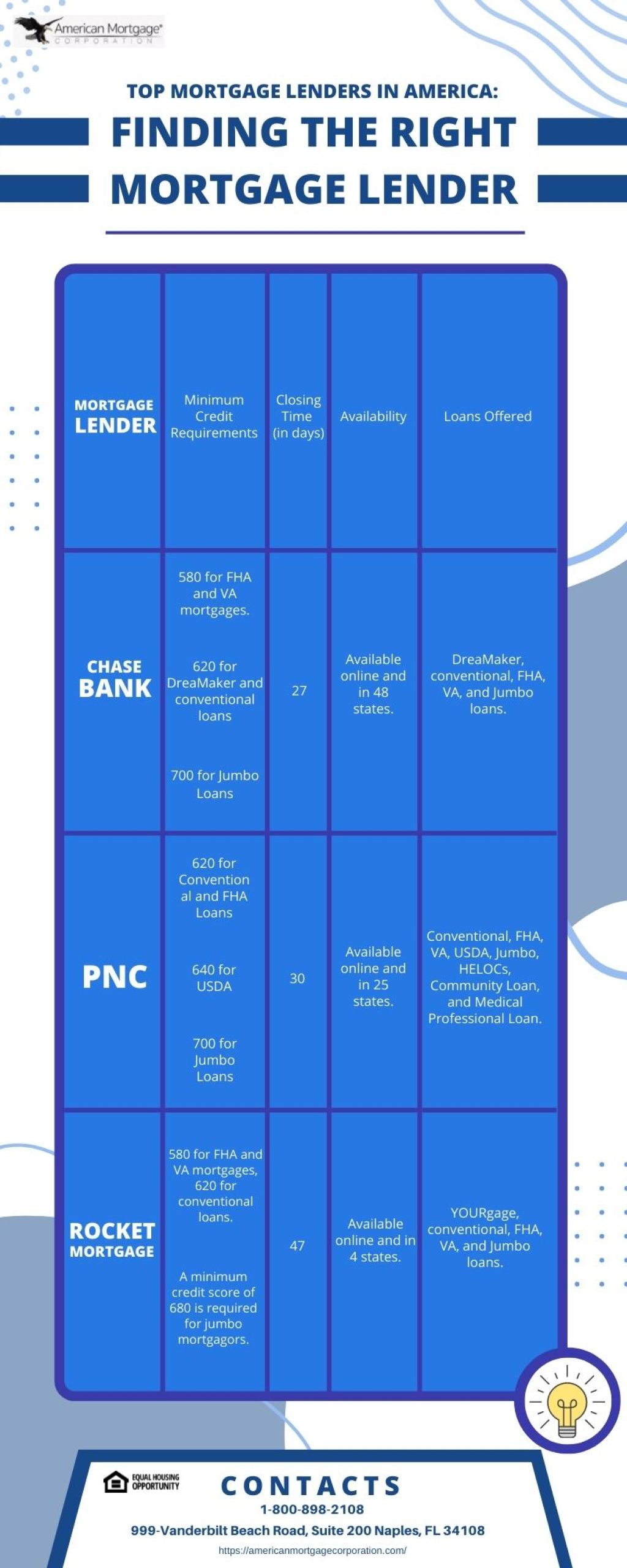

To help you narrow your choices, we’ve also included critical information about each lender, such as their locations, unique offerings, minimum credit score requirements, and average closing time.

With our list of top-rated mortgage lenders, you can be sure you’ll get the best possible deal on your new home loan.

So let’s dive right in; here are our 3 top-rated mortgage lenders in the United States.

Top Mortgage Lenders in America

Our 3 top-rated mortgage lenders in America are:

- Rocket Mortgage (Best For Lower Minimum Credit Scores)

- Chase Bank (Best for Lowest Minimum Down Payment)

- PNC (Best for Specially Tailored Offerings)

Here is why these three make the cut into our exclusive list.

Rocket Mortgage (Best For Lower Minimum Credit Scores)

Rocket Mortgage, formerly Quicken Loans LLC, is a Michigan-based mortgage provider. It provides an online experience, and applicants in all 50 states can enjoy the eClosing option it offers

Rocket Mortgage is popular amongst applicants for several reasons. One is that, unlike other mortgage lenders requiring a minimum credit score of 620, it accepts applicants with a 580 credit score.

Another reason it is a top-rated mortgage lender is that its “Fresh Start” program helps applicants improve their credit.

One of Rocket’s Mortgage flagship offerings is the YOURgage, a fixed-rate mortgage with a custom term of 8-29 years but with a 620 FICO score required.

Rocket Mortgage offers conventional, FHA, VA, and jumbo loans, but not USDA loans, so borrowers with 0% down payment may need to look elsewhere.

Rocket Mortgage doesn’t provide construction loans or home equity line of credit (HELOCs), but this shouldn’t be a problem if you’re buying a single-family house, second property, or condo.

Rocket Mortgage’s pre approval process takes as little as 8 minutes, with the typical loan closing being 47 days.

The closing date usually depends on how quickly you can provide all the essential information and documents.

Chase (Best for Lowest Minimum Down Payment)

Chase Bank, otherwise known as JPMorgan Chase, is headquartered in New York City. Its mortgages are offered in Washington DC and every other state except Alaska and Hawaii. Some lending programs, however, may not be provided in all states.

Chase Bank features competitive interest rates, lending programs for consumers with lesser down payments, and fast closing time frames.

Its flagship offer, DreaMaker, allows homebuyers with low credit ratings to make a 3% down payment. After taking a home buying program, eligible DreaMaker borrowers can win $500.

Chase also offers conventional, FHA, VA, and jumbo loans, while USDA loans and HELOCs are not part of its offerings. Chase’s minimum mortgage credit score is 620, like other lenders.

Chase offers 10- to 30-year fixed- and adjustable-rate mortgages. Chase also offers customers discounts, but with tight limits.

Customers with $150,000-$499,999 in Chase accounts get $500 off the mortgage processing charge. Those with $500,000 or more get $1,500 off processing fees. Chase gives a 0.25 percent rate discount for $1 million in deposits and investments.

Chase offers mortgage calculators, educational articles, and online customer service to help clients manage their mortgages.

Chase’s pre approval procedure takes two days, and customers typically close in three weeks.

PNC (Best for Specially Tailored Offerings)

Headquartered in Pittsburgh, Pennsylvania, PNC Bank operates in all 50 states and offers a comprehensive range of mortgage products, including low- and moderate-income mortgages.

It accepts applications online and in physical branches in various states.

PNC offers conventional, FHA, VA, and jumbo loans.

In addition, it offers different specialized loans, such as the rural Housing option, which provides a USDA mortgage option.

The PNC Community Loan also allows borrowers to put down as little as 3 percent (without paying private mortgage insurance) while selecting between fixed-rate and adjustable-rate mortgage terms.

It also offers a Medical Professionals mortgage option for interns, residents, fellows, or doctors who completed their residency in the last five years. This loan allows medical professionals to borrow up to $1 million without paying private mortgage insurance (PMI). They can either pick fixed or flexible rates.

PNC offers a unique customer experience through its Home Insight Tracker. This feature gives homebuyers a look into the homebuying process. It allows them to identify the mortgage payment they can afford and start browsing for properties with real-time rate estimates and loan choices.

It also lets loan applicants track the approval process and upload required documentation. The customer can also invite agents to check progress.

PNC’s pre approval process can take 30 minutes or a day, and its closings can take as little as 30 days.

Like most top mortgage lenders in America, PNC Bank’s minimal credit score is 620.

What is The Speed of Closing?

Some lenders can close on a mortgage in as little as two weeks, while others may take two months or more. Depending on your timeline, you may want to prioritize lenders who can close quickly.

Additionally, it’s important to remember that a fast closing doesn’t necessarily mean you’re getting the best deal. Be sure to compare interest rates, fees, and other terms before making a final decision.

How To Find The Mortgage Lender That is Right For You

Here are some questions to keep in mind as you shop around for a mortgage lender:

Does The Lender Have Offerings That Suit My Needs?

This is the first thing to note, as there’s no point in choosing a lender that doesn’t offer the type of mortgage you’re looking for.

So what kind of things should you be considering? Well, first of all, you need to think about the type of mortgage you’re looking for. Are you looking for a fixed-rate mortgage or an adjustable-rate mortgage? Do you want a 30-year loan or a 15-year loan?

Secondly, you need to think about your financial situation. What is your credit score? How much money do you have for a down payment? How much can you afford to pay each month?

Thirdly, you must consider each lender’s associated fees and costs. Some lenders offer more flexible options in exchange for higher interest rates. And some mortgage lenders charge higher fees for things like origination and closing costs.

Increased costs may increase the overall price of a property if the borrower does not obtain a seller or lender credit for closing costs, so do your homework and read the small print carefully ahead of time.

Request a quotation from your lender on all of the loan’s fees and costs, and seek clarifications on terms you’re unfamiliar with.

Lastly, consider the mortgage options being offered by the lender. For example, some mortgage lenders can provide unique offerings for professionals such as doctors, veterans, farmers, etc. Some may provide options from 0%-3% down payment rates, such as VA loans, FHA loans, etc.

It is necessary to consider whether the options provided by the mortgage lender are a good fit for you and whether it is in your best interests.

Does The Lender Have a Physical Location or Online Presence?

It is essential to consider whether the lender has an easily accessible physical location and/or an online presence. There are advantages and disadvantages to both types of lenders.

A lender with a physical location can provide you with more hands-on service and advice. However, you may have to contend with steeper fees and lengthy closing times.

An online lender can provide you with more convenience, and you may be able to get a lower interest rate since they do not have the overhead costs associated with physical lenders.

Additionally, an online presence can be helpful if you’re looking for additional resources or information about the mortgage process.

However, you may not have access to the same level of personal service and advice that you would receive from a physical lender.

Typically, top mortgage lenders provide a hybrid experience and allow customers to get the preferred option.

Conclusion

Our 3 picks for top mortgage lenders in America are Rocket Mortgage, Chase Bank, and PNC. Their top-rated status is hinged on their solid performance in areas such as their credit score minimum requirements, pre approval timeframes, mortgage closing time frames, down payment requirements, and versatility of loan offerings.

When choosing a mortgage lender, it’s essential to do your research and compare your options. Consider things like interest rates, fees, accessibility, and closing times. And always remember, whatever it is you’re looking for, with our help and by asking the right questions, you’ll surely find the best for you out there.